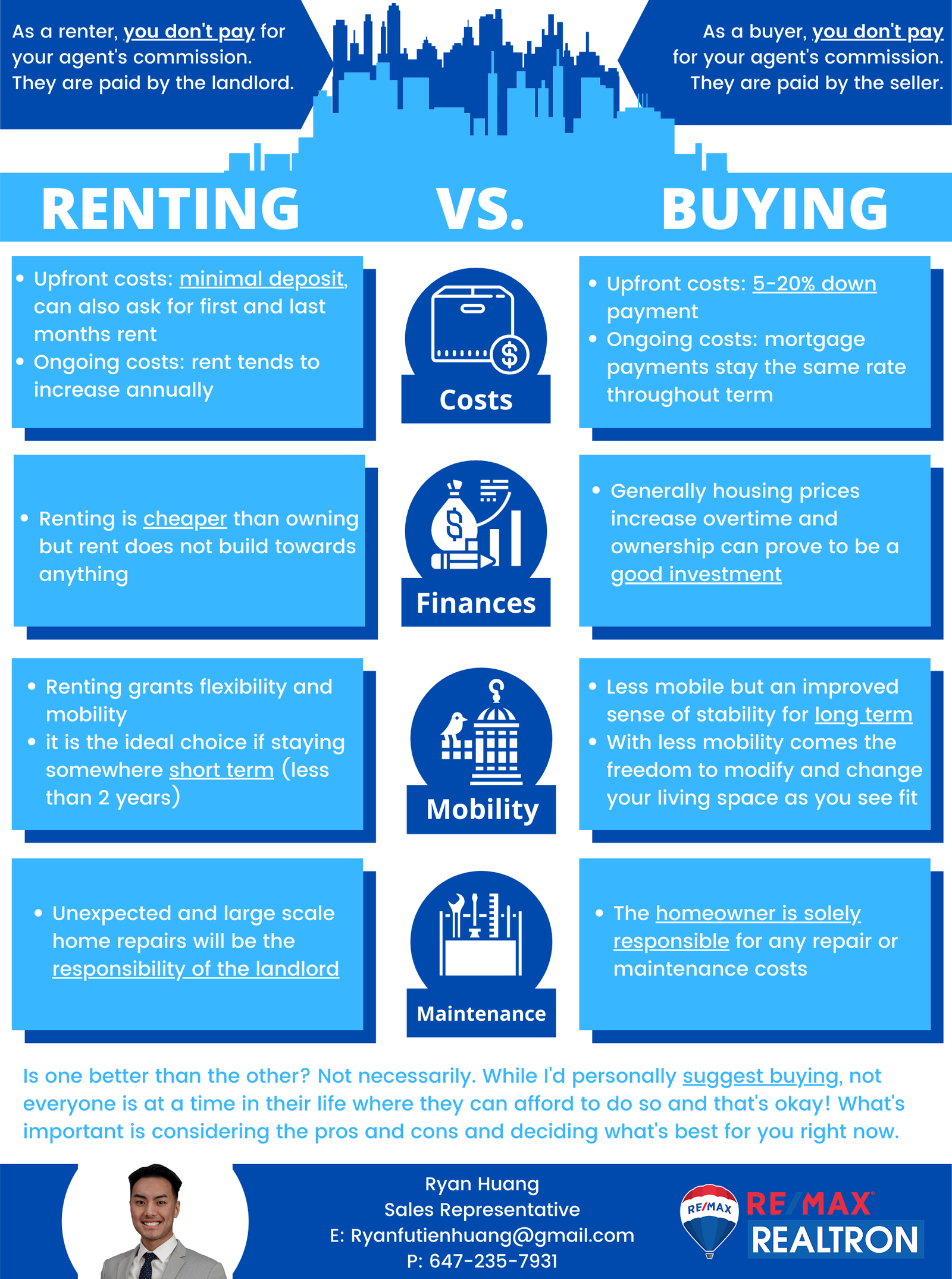

Generally, it's agreed upon that buying is always better than renting. However, this doesn't necessarily make renting a bad decision. There's a grey area that exists between the two options, and depending on where you are in your life and your own financial situation, one may suit you better than the other.

Costs

When considering buying a home, the first thing that comes to mind is the down payment. If we estimate a single bedroom condo in Toronto being $500,000, a 10% down payment would be $50,000. So, the upfront costs to buying are obviously quite substantial.

On the other hand, with regards to rent, a landlord may ask for first and last months' rent along with a security deposit. So, using the single bedroom condo in Toronto again, let's say rent averages approximately $2100 a month. First and last months rent would equate to $4200. Even with a security deposit, the upfront costs of renting are much lower. So, renting tends to be more affordable than buying.

Continuing on, monthly rent payments are usually lower than monthly mortgage payments. That being said, rent tends to go up annually, due to inflation. Whereas, mortgage payments will remain the same throughout your mortgage term. It is also important to consider that rent payments will never end, as opposed to mortgage payments which will eventually be paid off. This leads to the next discussion.

Finances

As a result, a strong argument for buying, as opposed to renting, would be that the home will eventually be paid off. Many think of a home as "forced savings". For the regular person, the eventual selling of their home is the easiest way to see long-term wealth growth. Overtime the home will appreciate, and hopefully provide a good return on investment when sold, assuming a regular market.

Mobility

Finances are not always the driving force between the buying vs. renting debate, mobility plays a part as well. For the short term, renting is probably the better option. This can involve school or moving due to work. If you're not ready for commitment or sure of settling down somewhere, renting is probably a safer option.

However, if financially stable and willing to settle down. Buying is a good option. It provides a sense of stability and security. The danger when renting, while rare, is that the landlord may end your tenancy. This can be for a multitude of very specific reasons, such as a landlord's family member needing to stay at the rental property, but they are possible. With the commitment of buying comes the emotional security of you being your own landlord.

Also, once a property is bought, you can change and renovate the living space as you see fit. This is not necessarily the case with renting.

Maintenance

When renting, any large scale repairs or maintenance of the property will be the responsibility of the landlord. However, for homeowners, the responsibility rests solely on the their shoulders.

There are many things that require attention when owning a home: plumbing, roof, external structure, electrical, heating, ventilation, A/C, drainage, etc. These can also range from regular annual maintenance to larger issues that require a bigger budget to solve.

Another important note, if staying in a condo as opposed to a house, there will monthly maintenance fees to pay to your condo, on top of your mortgage. So, maintenance shouldn't be something taken lightly and its important to know the responsibilities of being a homeowner.

So what's best?

It's sort of a trick question because it really depends on where you are in life and what you can afford. I still personally think that buying is the best choice in the long run. This opinion comes from a family of realtors who have always told me that "buying is best". It does tend to appreciate overtime and is usually the easiest way for people to see a large scale financial growth in their initial purchase.

In the end, it all depends on you. Either way, it's important to talk to a Realtor whether you're interested in renting or buying because you want to have someone with your best interests in mind, especially when you don't have to pay! They'll be paid through the landlord or the seller. So, weigh the pros and cons and make sure you consider where you see yourself in the future.